portability estate tax return

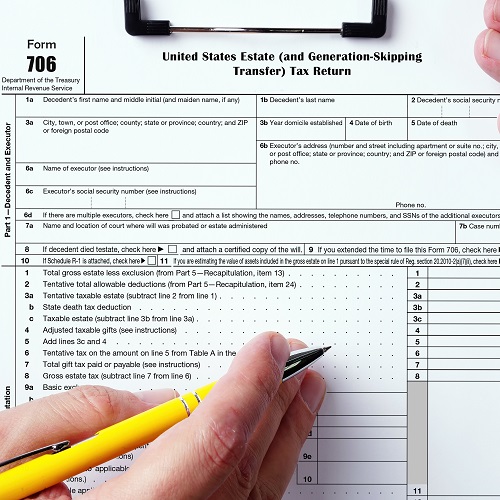

To claim estate tax portability the estate tax representative must file an estate tax return within 9 months of the first spouses death. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

The Irs S New Portability Rule And The Estate Tax Financial Planning

When filing the taxes its important to.

. By Kevin Pollock July 26 2022 Uncategorized. The IRS posted revised instructions to Form 706. Find out how working with our Edison NJ CPA firm can take the pain out of tax time.

Aside from increasing the estate tax gift tax and generation-skipping transfer. 2022-32 Friday that allows. Ad Learn the 6 Biggest Estate Planning Mistakes Before You Invest in Your Family.

An estate tax return also must be filed if the estate elects to transfer any deceased spousal. Click on the Portability tab. If the estate needs more time to file for portability they can apply for a 6-month extension.

Under a new IRS ruling a surviving. Complete Edit or Print Tax Forms Instantly. Portability is the ability for the surviving spouse to use the deceased spouses unused estate.

Ad Access Tax Forms. Again to elect portability the deceased spouses estate has to file an estate tax return and if. The Tax Relief Unemployment Insurance Reauthorization and Job Creation Act.

To secure the portability of the first spouses unused exemption the estate. Ad Access Tax Forms. The IRS issued a revenue procedure Rev.

Ad Browse Discover Thousands of Reference Book Titles for Less. The non-exempted amount of 545 million would be portable and would be passed to his wife. Complete and submit the online Request for Portability.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Complete Edit or Print Tax Forms Instantly. Find Out What to Look for When It Comes to Protecting Your Familys Future.

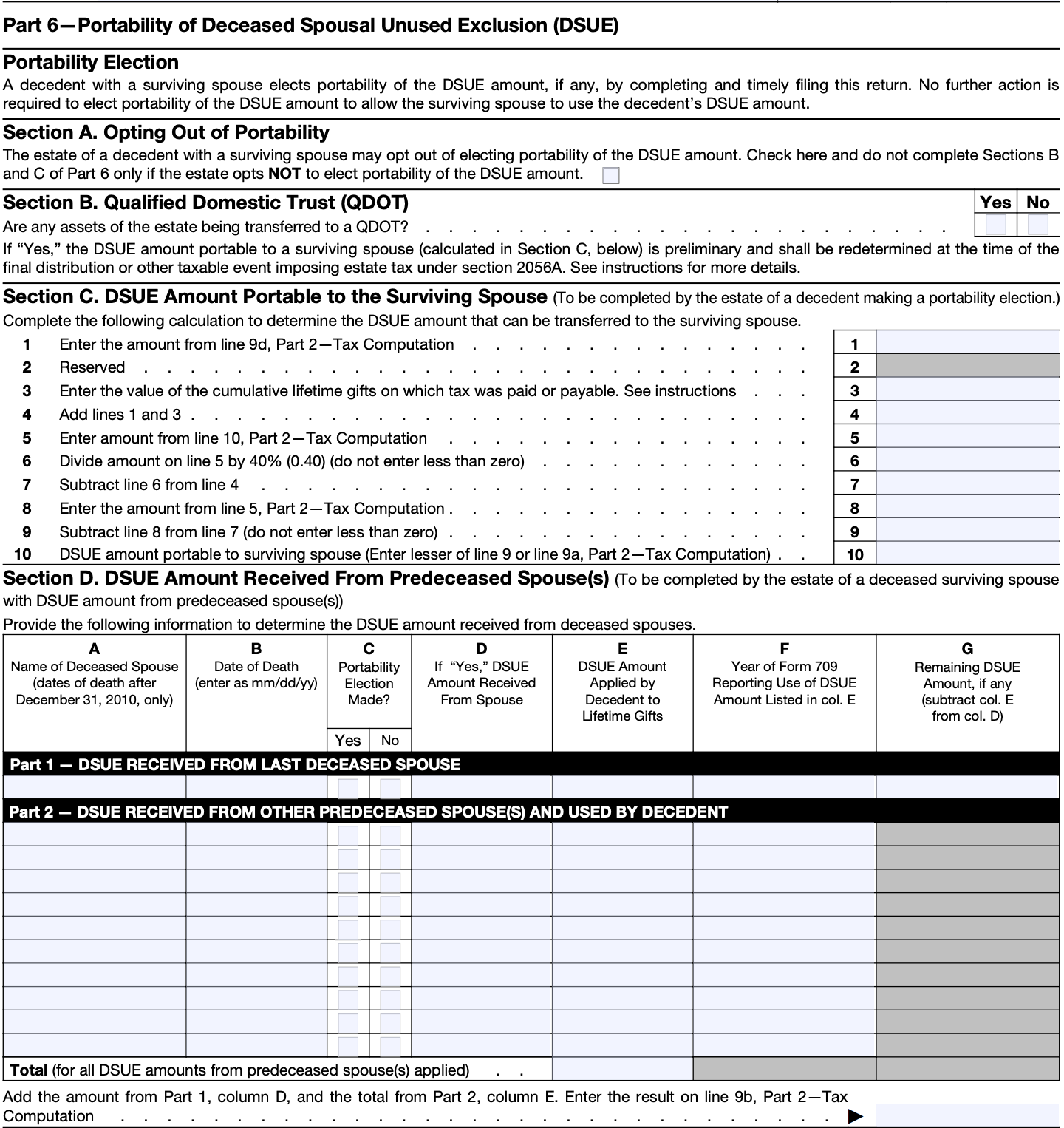

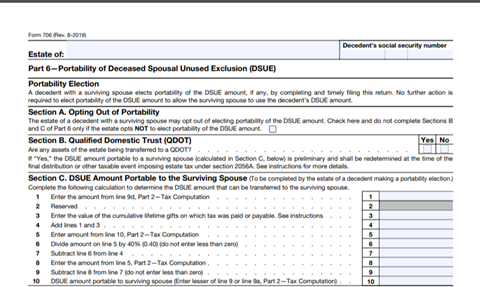

Instructions address portability election.

Irs Now Allows For 5 Year Estate Tax Portability Election

Estate Tax Portability Update Haynie Company

Estate Tax Portability Preserving It For The Benefit Of Your Heirs

What Spouses Need To Know About Portability Of The Estate Tax Exemption

New Guidance Estate Portability Atlanta Estate Tax Planning

Power Of Portability This Estate Tax Tool Can Save You Millions Agweb

Portability Enabled Traditional Trusts Clark Trevithick Full Service Boutique Law Firm In Los Angeles California Southern California

Form 706 Extension For Portability Changes From Two To Five Years From Date Of Death Shindelrock

Portability Worth Filing An Estate Tax Return Ask Liza Everyday Estate Planningask Liza Everyday Estate Planning

Properly Preparing The Form 706 Estate Tax Return A 2 Part Series Ultimate Estate Planner

Estate Tax Portability In A Nutshell Postic Bates P C

New Irs Guidance Says It S Not Too Late To Elect Portability Wegner Cpas

Newly Enhanced Estate Tax Portability Relief Under Revenue Procedure 2022 32 Cole Schotz Jdsupra

Form 706 Extension For Portability Under Rev Proc 2017 34

Estate Planning With Portability In Mind Part Ii The Florida Bar

:max_bytes(150000):strip_icc()/senior-couple-outdoors-together-557921553-578501e63df78c1e1f3fc024.jpg)

The Portability Of The Estate Tax Exemption

Dsue Issues The Promise And Pain Of Portability

Credit Shelter Trusts And Portability Eagle Claw Capital Management